The compensation we receive from advertisers isn't going to affect the recommendations or suggestions our editorial crew offers within our content articles or otherwise influence any with the editorial content on Forbes Advisor. When we work hard to offer accurate and current information and facts that we expect you will see applicable, Forbes Advisor would not and can't promise that any details provided is comprehensive and helps make no representations or warranties in link thereto, nor towards the accuracy or applicability thereof. Here is a summary of our partners who present products which We've affiliate back links for.

For those who’re accredited, money can be deposited within your banking account the same working day you apply — should you post your software previously more than enough on a business day. Its most important downside is you require a number of yrs of favourable credit score background to qualify.

1Personal Loans Charge and Conditions Disclosure: Rates for personal loans furnished by lenders over the Credible platform vary among six.ninety nine% - 35.ninety nine% APR with conditions from 12 to eighty four months. Charges presented incorporate lender discounts for enrolling in autopay and loyalty packages, where by relevant. True rates might be distinct with the costs marketed and/or proven and can be based on the lender’s eligibility standards, which consist of elements for example credit rating score, loan quantity, loan term, credit history usage and background, and range dependant on loan function. The lowest premiums obtainable typically need exceptional credit, and for many lenders, could possibly be reserved for precise loan reasons and/or shorter loan conditions. The origination rate charged because of the lenders on our platform ranges from 0% to 12%. Just about every lender has their own qualification requirements with respect to their autopay and loyalty reductions (e.

Apart from the regular principal and desire payments created on any kind of loan, for private loans, there are many charges to consider Be aware of.

A similar predicament occurs whenever a scholar who acquired loans to get a graduate or Qualified degree plan later on returns to school and enrolls within an undergraduate program. In this case, loan quantities that the scholar been given being a graduate or Expert college student are usually not counted from the undergraduate combination loan Restrict (see Instance 4 earlier in this chapter). EXAMPLE five: AGGREGATE LOAN Limitations And extra DIRECT UNSUBSIDIZED LOAN AMOUNTS WHEN PARENTS ARE Struggling to Attain DIRECT Additionally LOANS A dependent college student is handled as an independent college student for loan limit applications and gets extra Direct Unsubsidized Loan money (approximately the extra quantities accessible to independent undergraduates) for the 1st 3 a long more info time of a four-12 months method as the college student’s father or mother is not able to get a Immediate Moreover Loan for every of those many years.

If you need rapid funding, it’s ideal to Call lenders on to get a clear idea of how (and how rapidly) they may send your resources. Remember that velocity can come at the cost of substantial fascination prices and costs.

If you choose to click the inbound links on our internet site, we may well get payment. If you do not simply click the back links on our internet site or make use of the mobile phone quantities detailed on our internet site we will not be compensated. In the long run the choice is yours.

Unsubsidized loans are in the Immediate Loan application—so a credit score Verify isn’t needed with these loans either. Unsubsidized loans are offered to undergraduate, graduate and professional college students. Economic need to have isn’t necessary to be qualified.

You may be subject to high desire premiums and fees in addition to reduced loan amounts. Borrowing revenue with lousy credit history can include a share of Positive aspects, but commence with caution.

For borrowers with negative credit score, Universal Credit history could possibly be your golden ticket to your cash you require. That has a least credit score rating prerequisite of only 560, Universal Credit is a top option for subprime borrowers. Although loan prices can be better, they usually are With regards to borrowing revenue with bad credit rating.

Though individual loans with lousy credit rating are feasible for getting, they is probably not the ideal monetary go. Some lenders can lend to borrowers with poor or truthful credit rating scores. One thing to take into consideration however is that your desire rate will probably be better than should you had a great credit score score.

Mudroom addition: Using a mudroom in your house is a terrific way to assist continue to keep outdoor messes from coming into into the remainder of the residence. When a person comes in from Doing the job outdoors, like reducing the grass, for example, they're able to clear away their filthy clothing and footwear at once and forestall grass clippings from stepping into the other areas of the home.

Editorial Observe: Intuit Credit history Karma gets payment from 3rd-bash advertisers, but that doesn’t have an affect on our editors’ views. Our 3rd-bash advertisers don’t review, approve or endorse our editorial content material.

A lot of lenders these days allow borrowers to post applications on the internet. Immediately after submission, data is assessed and verified because of the lender. Some lenders make a decision immediately, while some may have a couple of days or perhaps weeks. Applicants can either be approved, turned down, or acknowledged with disorders. Regarding the latter, the lender will only lend if certain situations are fulfilled, for instance distributing added pay back stubs or documents connected to belongings or debts.

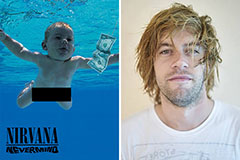

Spencer Elden Then & Now!

Spencer Elden Then & Now! Tia Carrere Then & Now!

Tia Carrere Then & Now! Ben Savage Then & Now!

Ben Savage Then & Now! Michelle Trachtenberg Then & Now!

Michelle Trachtenberg Then & Now! Heather Locklear Then & Now!

Heather Locklear Then & Now!